Categories: News

News

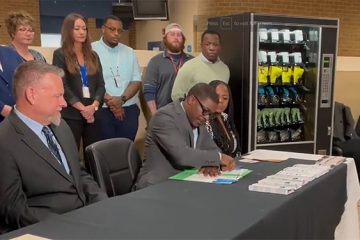

JOIN THE MOVEMENT TOWARDS HARM REDUCTION WITH CUSTOMIZED VENDING MACHINES

Join the Movement Towards Harm Reduction with Customized Vending Machines In the bustling streets of Milwaukee, Wisconsin, an innovative solution to combat the opioid epidemic has emerged – Harm Reduction Machines. These unique vending machines, Read more…